Glencore, the metals mining giant

The mining sector is being weak with lower prices

January 5, 2016

Morgan, Sachs, Glencore have lawsuit against zinc price conspiracy dismissed.

January 11, 2016

Glencore: The Giant Fell 72% in 2015

By Val Kensington

• Jan 4, 2016 9:29 am EST

Glencore, the metals mining giant

Glencore (GLNCY), the metals trading and mining giant, has fallen 72% since the beginning of 2015. The bearishness in the entire base metals sector pulled Glencore’s prices down to multiyear lows.

Enlarge Graph

Glencore maintains a strong bearish sentiment

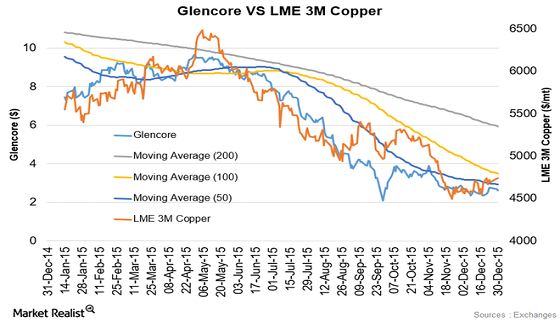

As you can see in the above graph, Glencore has been below its 200-day moving average for all of 2015. That’s a bearish signal. Except for mid-April to mid-July, Glencore’s higher moving averages were above its lower moving averages. The 200-day, 100-day, and 50-day moving averages all trended downward. If the higher moving averages are above the lower moving averages and they’re all aligned downward, then the situation is very bearish.

Glencore fell 73% from its peak in 2015

Glencore’s highest day’s close in 2015 was $9.68 on April 29. Since the peak at the end of April, Glencore has fallen 73%. The lowest day’s close for Glencore was $2.07. Glencore is currently trading at 25% above that. Prominent price regions in 2015 were $7.28, $4, and $2. They’re expected to act as important support and resistance zones in 2016. As you can see in the graph, Glencore shares a strong correlation with copper prices. Since the beginning of 2015, copper fell 25%. Glencore fell 72%.

Other base metal miners also lost a significant portion of their values in 2015. Vale SA (VALE), Freeport-McMoRan (FCX), BHP Billiton (BHP), and Rio Tinto (RIO) fell 60%, 71%, 41.4%, and 37%, respectively. Base metal ETFs were also on a downtrend for most of 2015. The PowerShares DB Base Metals ETF (DBB) fell 25% during the year.

http://marketrealist.com/2016/01/glencore-giant-fell-72-2015/

Metals Rebound From Biggest Drop in 3 Months as China Intervenes

Agnieszka De Sousa

AggieDeSousa

January 5, 2016 — 6:00 AM GST

Updated on January 5, 2016 — 5:15 PM GST

Copper climbed the most in two weeks and nickel gained after China sought to support its stock market following Monday’s rout that sent metal prices tumbling.

State-controlled funds in China bought equities and regulators signaled a selling ban on major investors will remain beyond this week’s expiration date, according to people familiar with the matter. Most metals traded in London and a gauge of mining shares rose.

An index of six main contracts on the London Metal Exchange slumped the most since September on Monday after a plunge in mainland China shares triggered a trading halt. Slowing economic growth in the Asian country, the biggest commodities buyer, has curbed demand for metals and sent prices to near the lowest in six years. That’s prompted Chinese refiners and some of the world’s top miners to pledge output cuts to reduce a glut of material.

“Chinese stock markets have stabilized, thanks largely to government intervention, which has clearly helped sentiment in the metals space,” David Wilson, an analyst at Citigroup Inc. in London, said by e-mail.

Metals Prices

Copper for delivery in three months climbed as much as 1.5 percent, the most since Dec. 18, and was up 1.2 percent at $4,665 a metric ton by 1:03 p.m. on the LME. Stockpiles of the metal held in warehouses tracked by the bourse fell for a fourth day. Nickel prices advanced 1.4 percent.

The FTSE 350 Mining Index of 11 stocks gained 2.3 percent after earlier rising the most in almost two weeks. Vedanta Resources Plc climbed 5.8 percent and Glencore Plc rose 4.1 percent.

On the LME, aluminum and zinc also gained, while lead fell and tin declined for a fourth day to the lowest since Nov. 24. A speculative short position, or bet on lower prices, in nickel shrunk to less than 8 percent of open interest as of Dec. 30, from 29 percent in November, according to Marex Spectron Group.

Slumping prices have hurt producers, including those in Indonesia, which before a 2014 export ban was the world’s biggest shipper of mined nickel. The country may relax rules on the export of metal concentrates following the collapse in metals prices, while keeping a ban on raw ore shipments, a minister official told Bloomberg.

http://www.bloomberg.com/news/articles/2016-01-05/copper-climbs-as-base-metals-trim-biggest-slump-in-three-months